Why Evanston Taxes go 📈

An exploration into 10 years of District 65 and ETHS taxation and enrollment

It’s hard to write about taxes without putting my readers to sleep. So bear with me here! I want to convince you of the following:

Education-based Taxes in Evanston have gone 📈 in the last 10 years in Evanston.

This is partially driven by District Administrations but also by Cook County Property Assessments.

Evanston taxpayers have chronically underfunded District 65 compared to ETHS.

I went through all the county documents and District taxation reports.

EAV is the total value of all properties in the ETHS/District 65 area. You’ll see it jumps every 3 years. If you’re a property owner, you know this is because Cook County re-assesses your property every 3 years.

The levies for both ETHS and D65 are below This is the total amount that local taxpayers give to the Districts. This accounts for more than 70% of both District’s total funding. You’ll see a jump in 2016 for D65, this is because of the referendum passed in 2017..

Then, if you look at the last 10 years, you can get a sense of how much public school tax levies have gone up.

So in the last 10 years, the total assessed values of properties in Evanston/Skokie have gone up 47%. During the same time, the District 65 total assessments increased 51% (faster than the EAVs, primarily due to the referendum) and ETHS assessments have increased at a much slower rate (31%).

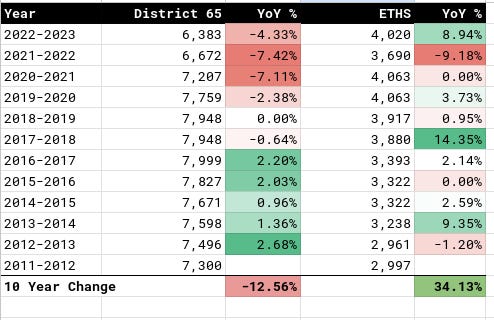

But if you look at enrollment over the same period, ETHS has a third more students than they did 10 years ago.1 Compared to District 65, which is down 12% during the same period.

Now we can take the total assessment and divide by enrollment to get a more normalized sense of how much local taxpayers fund an Evanston K-8 student versus an Evanston High School student. The difference is quite stark.

The gap is closing for two reasons:

The 2017 Referendum helped District 65 catch up a bit

District 65’s enrollment cratered during and after COVID and has not recovered (and probably won’t).

Before the 2017 referendum, Evanston taxpayers were funding high school students almost $7,000 or more per head! That’s just wild to me. So I reached out to the ISBE about some of the state-wide averages, which are similar, and they gave me some insight

We have observed this trend as well, but due to a number of factors, and since districts have local control over spending, the answer to the question of cost will be different for different districts. See #2 for further information.

And they provided some examples

For instance, the school counselor ratio is higher for elementary schools (450:1) than for high schools (200:1), but the core intervention teacher and librarian ratios are higher for high schools (600:1) than for elementary schools (450:1).

Another factor is that the programming offered by high school in some cases may be more comprehensive. For example, electives, athletics, advanced and remedial courses may drive up costs, but these are local decisions.

There are about three times more elementary than high school districts, and some particularly high vs. low spending (per-pupil) districts might be impacting the averages.

I don’t know - I don’t find those arguments for the gap to be totally convincing. Leave a comment to suggest what I am missing here!

The challenge for District 65 is that even if they manage to get this normalized so the per-pupil funding is the same, they have so many structural disadvantages such as transportation costs, building maintenance, and administrative duplication (18 principals and vice principals versus 1 set at ETHS).

It’s interesting that you can see the immediate recovery in ETHS enrollment after COVID that you don’t see with District 65. The D65 Board loves to blame COVID for the enrollment drop but perhaps this is an argument that there are bigger problems.

I went to see the musical at ETHS last weekend and if the stellar arts programming is part of what my taxes go for, I have no complaints. I guess I feel (and feelings have little basis in fact, but nonetheless) that d65 offers little to such a wide swath of their population, they don’t deserve any more of my hard earned dollars. In 8 years, my mortgage payment has gone up almost $1000 per month. This is at 3% interest rate. Yes, some of it is an increase in insurance, but the rest is taxes. I know it’s not all d65, but everyone keeps touting d65 as a reason to live here and bear the higher cost of living. It’s unaffordable. One more increase and I’ll have to sell up and get out. But hopefully I will be able to go somewhere that the local school district isn’t run by complete boobs and I won’t have to deal with the additional expenses of private school. That certainly was never part of the plan when I purchased a home here.

I wonder if some of the difference is for equipment. Ever seen the auto shop at ETHS? Absolutely incredible - basically a jiffy lube in a high school. And I wonder if high school science labs are more expensive than those in the junior high schools.